Commercial Solar Rebates

As a small business owner, you want to reduce your operational costs. And you’re aware of the effect your business has on the environment as well. Installing a solar power system on your office or warehouse rooftop makes you a self-sufficient, energy-producing organization. Many Australian businesses start installing solar systems to cut costs and to follow the clean energy trends.

Did you know solar small business incentives and rebates from the government are also available? We’ll take a look at these below.

Solar Renewable Energy Certificates

Renewable energy certificates or renewable energy credits (RECs) represent the energy generated by renewable sources, such as solar or wind power facilities.

Solar renewable energy certificates (SRECs) are a type of (RECs) that is specifically generated by solar panels. Commercial businesses and homeowners earn one SREC for every one megawatt-hour (MWh) of electricity generated.

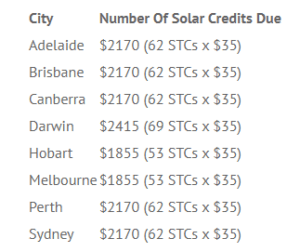

STCs and Solar Credits

The Solar Credits program is based on the Renewable Energy Certificate (REC) system. The federal government issues two types of renewable energy certificates based on the size of production.

- LGCs – for solar panel systems > 100kW

- STCs – for solar panel systems ≤ 100kW

Both (STCs) and (LGCs) are tradable commodities attached to eligible installations of solar systems and other types of renewable energy generation like solar hot water and heat pumps. In a commercial solar system, their benefits can be thousands of dollars.

Environmental Upgrade Finance (EUF) Agreements

Under an Environmental Upgrade Finance (EUF) agreement, NSW, Victoria, and South Australia offer low-interest loans for solar. Besides this rebate environmental upgrades are available too.

According to Environmental Upgrade Finance, (EUF) agreement business owner can borrow money to upgrade his commercial building as an environmental upgrade. They will repay this money at the rate set by the local council.

As it is not like traditional financing systems, business owners can enjoy some benefits like low interest. The local councils provide security to the financing institutions.

Benefits of Environmental Upgrade Finance (EUF) include

- Competitive fixed interest rates;

- Long-term finance (10-20 years);

- No additional security is required;

- No deposit required;

- With consent share costs and benefits.

Environmental Upgrade Finance is suited to businesses who:

- have a long-term tenancy;

- They can pay for a long time with a low amount.

Participating business leaders include:

- RateSetter – Green Loans

- ANZ – Energy Efficient Asset Finance

- Bank of Queensland – Energy Efficient Equipment Finance

Solar Rebates in Australia

As part of the Net Zero Plan Stage 1, the Australian government has set a target to achieve net-zero emissions by 2050. Solar energy is, of course, the basis upon which this strategy is built. As a result, the Australian Government is providing substantial incentives to homeowners who install solar panels and batteries. There has never been a better moment to transition to solar than now, with solar power system prices continuing to plummet.

The solar panel consultants at Ausgreen Solar will walk you through all of the different programs and incentives to give you a comprehensive picture of how much money you may save, making this your one-stop guide to the commercial solar rebates. Australia

Energy Efficiency Upgrades for Householders

Households and small companies may be able to save money by upgrading their houses’ energy efficiency, such as replacing downlights with LEDs. The HEER technique stands for Home Energy Efficiency Retrofits. Residential and small business improvements are conducted by HEER-accredited firms, who may be able to provide residential and small business clients subsidized energy-saving services or goods.

How You Can Participate

If you want to enhance your home’s energy efficiency or buy an energy-efficient item, you should contact the companies who offer these services. Accredited Certificate Providers, or ACPs, are businesses that have been accredited under the ESS. The List of ACPs page contains a list of all ACPs covered by the ESS. Accredited businesses for household and small business operations may be able to help you enhance your home’s energy efficiency or provide energy-efficient products.

More information on how to save energy in your house may be found at the NSW Department of Planning, Industry, and Environment.

ATO Tax Concessions

Small Business Entity Concessions

Small firms with yearly revenues of less than $2 million may be eligible for a variety of tax breaks. This is true whether you’re a solo trader, a partnership, a corporation, or a trust.

Eligibility

You must determine if your company is eligible for the concessions in general. Then you may pick one or more tax breaks that are right for your company and double-check your eligibility. You should also check each tax year to see whether you are qualified.

Also, depending on who buys the system, ATO entity concessions may apply to either the superfund or the leasing business.

Please check the ATO website for the most up-to-date information.

Green Energy Trading is the source of this information.

For the most up-to-date information on pricing and changes, contact your power supplier or visit their website.